Content Marketing for Financial Services: Building Trust Before the First Meeting

Content marketing for financial services has become one of the most powerful ways to win new clients. In a sector where trust and authority mean everything, content can establish credibility long before a potential customer agrees to a meeting. The financial services industry is built on complex subjects and cautious decision-making. Clients want reassurance, clarity, and proof that they are dealing with a reliable partner. By creating and sharing valuable resources, financial services brands can achieve this trust and show expertise at the earliest stage.

This guide explains how to design a financial content marketing strategy that builds confidence before first contact. We will cover why trust is central to the financial services sector, how financial institutions can prove authority, and which content formats attract and retain clients most effectively. We will also look at compliance, search engine optimisation, and measurement, giving financial services marketers a clear roadmap for success.

Why Trust Comes Before Everything in the Financial Services Industry

Trust is more fragile in the financial services industry than in most sectors. Scandals, crises, and economic uncertainty have left many consumers sceptical about financial institutions. Some reports suggest only a small percentage of the public has full confidence in banks, insurers, or asset managers. This makes building trust an essential part of winning new business.

Financial decisions are not like other purchases. Choosing a credit card, investment platform, or mortgage lender often means long-term commitment. Customers want to know they are in safe hands. That assurance begins before the first conversation.

When financial services companies publish accurate, clear, and practical resources, they position themselves as thought leaders. Explaining the stock market in simple terms, answering questions about credit card fees, or guiding people through mortgages helps to reduce complexity. Clients feel reassured by high-quality content that is accessible and reliable. Over time, this creates confidence and encourages prospects to take the next step.

The Foundations of Trust: Authority, Compliance and Strategy

Authority Through Expertise

Financial services are classified by Google as a “Your Money or Your Life” industry. This means search engine algorithms apply higher standards, rewarding websites that demonstrate expertise and authority. To succeed, financial services marketers need more than just good writing. Content must reflect genuine knowledge.

One way to achieve this is by involving in-house specialists. Articles written by financial experts or based on their insights carry weight with readers. Another approach is structured interviews, where writers gather knowledge from professionals and turn it into easy-to-read articles. Whether explaining investment trends or providing a guide to choosing a credit card, content that comes directly from expertise builds credibility.

Compliance as a Trust Signal

The financial services sector is tightly regulated. Compliance reviews can slow down content production, but they also serve as reassurance. When financial institutions communicate with care and consistency, clients notice.

The best approach is to involve compliance teams early in the process. Building a shared calendar, agreeing on approved wording, and clarifying rules in advance make it easier to publish quickly. A financial services company that shows accuracy and responsibility in its messaging not only avoids risk but also builds trust with potential customers.

Why a Bottom-of-the-Funnel Strategy Works First

Many content strategies in the financial services industry start with broad educational content, such as “what is a mortgage?” or “how does the stock market work?” While these articles can attract visitors, they are not always effective in generating business quickly.

A better approach is to begin with bottom-of-the-funnel (BOFU) content. This means targeting people who are close to making a decision. For example, someone searching “best business credit card for travel” or “top invoice financing providers” has strong buying intent. By answering these queries directly, financial services brands can engage prospects at the right time and guide them towards a decision.

Formats That Build Confidence Before First Contact

Different content formats work at different stages of the journey. For financial institutions, the most effective ones are those that prove knowledge, simplify complexity, and show transparency.

Interactive Tools

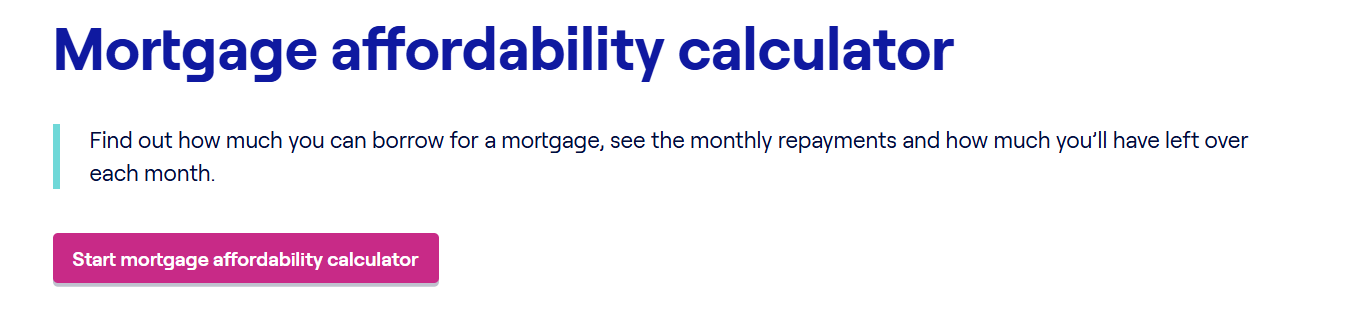

Calculators, comparison checkers, and financial planning tools provide immediate value. For example, a mortgage calculator that breaks down monthly repayments gives potential customers clarity. Tools also demonstrate transparency, which strengthens trust.

Podcasts and Audio

Time-poor professionals may prefer to listen rather than read. Podcasts allow financial services brands to share expert views in a personal way. A series of market updates or financial planning tips can make a company a familiar voice, building trust over time.

Storytelling

Stories are one of the most effective ways to connect with an audience. Sharing real customer experiences, such as saving for a wedding or navigating the stock market, shows how financial products make a difference in real life. These stories help potential customers imagine themselves achieving the same results.

Short Visual Content

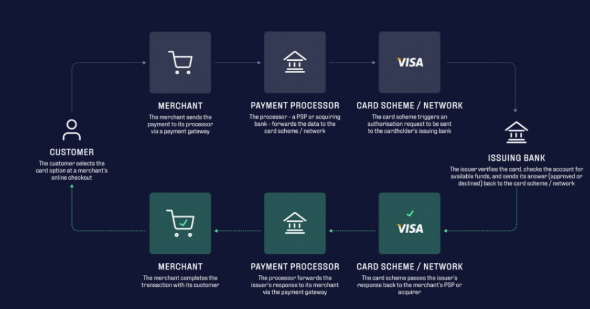

Financial topics can be difficult to follow. Short videos, infographics, or simple explainers make complex subjects easy to understand. A visual showing how different credit card fees add up can communicate a message more effectively than a long article.

Making Content Easy to Find: SEO and Packaging

Even the best article or tool cannot generate results if no one sees it. Search engine optimisation is therefore a crucial part of a financial content marketing strategy.

In practice, this means identifying the intent behind search queries. Someone typing “credit card” may only want a definition, but a person searching “best credit card for freelancers” is much closer to making a choice. Financial services marketers need to focus on these high-intent searches.

Content should also be easy to navigate once people arrive on a site. Grouping articles into clear sections, linking related resources, and providing logical pathways helps users explore. Each piece of high-quality content should connect to others, building a stronger impression of expertise.

Measuring engagement matters too. Simple metrics such as page views do not always reflect success. Financial services brands should track whether users are spending time on content, returning for more, and moving further into the customer journey. This shows that trust is being built and content is influencing decisions.

Meeting Clients Where They Are

To win trust, content must reach the audience on the platforms they already use. Social media is an essential part of distribution, especially LinkedIn, where financial services companies can share insights, articles, and thought leadership. Posting regular, relevant updates helps keep a brand as a thought leader in the eyes of potential customers.

Email also plays a strong role. A simple sequence, such as a helpful guide followed by a customer story and then a practical tool, can guide prospects towards making contact.

Employee advocacy adds another layer. When staff share insights or comment on industry news, it shows the company’s expertise goes beyond marketing. It feels more authentic, which helps to build trust.

Working with Compliance

Content production in the financial services sector often slows down due to compliance checks. But this does not have to be a barrier. With the right workflow, compliance can be a support system rather than a challenge.

A shared calendar that includes compliance reviews, a set of approved phrases, and a clear process for highlighting claims that need evidence can save time. By preparing content with compliance in mind, financial institutions can publish more consistently and show responsibility in their messaging.

Measuring Impact in the Right Way

Reporting the wrong metrics can damage the case for investment in content. Senior leaders in financial services brands are less interested in page views and more focused on business results.

The most important measures include:

By proving that content drives customer acquisition and retention, financial services marketers can show why it deserves investment.

FAQs

Why does content marketing matter in financial services?

It helps financial institutions build credibility by creating and sharing valuable content that proves expertise and builds trust before any direct engagement.

Which types of content work best?

Interactive tools, podcasts, visual explainers, and storytelling all build confidence by simplifying complexity and showing real-life impact.

How should compliance be managed?

By involving compliance teams early, using approved wording, and planning sign-off stages to reduce delays.

Why focus on bottom-of-the-funnel content first?

Because it targets potential customers already close to making a decision, which speeds up results and proves value faster.

Conclusion: Turning Content into Trust

For financial services companies, trust comes before everything. Clients want to know they are dealing with experts who understand their needs and provide clear, reliable guidance. A strong financial content marketing strategy can deliver that trust before a first meeting ever takes place.

By focusing on authority, compliance, and high quality content formats that resonate with the target audience, financial services marketers can set their brands apart. Building visibility through search engine optimisation and distribution ensures the right people see the right messages at the right time.

Now is the time to use content to win trust, build relationships, and guide potential customers towards choosing your services. If you are ready to strengthen your strategy and achieve real results, get in touch today and let’s create content that builds confidence from the very first interaction.