Why Doesn’t My Financial Services Website Produce More Leads?

Why doesn’t my financial services website produce more leads? It is a question that frustrates lots of people across the industry. Financial advisors who have invested time and money into a professional-looking site, publish blog posts regularly, and even see steady traffic coming in from search engines, are left wondering why they are not getting more work.

Why is my website not producing more leads when it looks credible, loads quickly, and appears to say the right things? The answer is rarely one single fault. Most of the time, the problem sits somewhere between who the site attracts, how clearly it communicates, and whether it builds enough confidence for someone seeking financial guidance to take the next step.

This article explores how to get your financial services website to produce more leads from a practical perspective. It looks at traffic quality, content, layout, trust signals, and lead generation mechanics, all to try help you get more work.

The uncomfortable truth about traffic without enquiries

One of the most common scenarios is a website that receives visits but generates no calls or form submissions. On paper, that sounds great, but in reality, it usually signals a mismatch.

Traffic alone does not mean opportunity. Search engines can send large volumes of users who are curious, researching, or simply browsing. Financial services decisions are rarely impulsive, so visitors arrive with specific pain points. If the site fails to meet them straight away, the visitor will leave quietly.

A good chance to convert is lost when the traffic is either too broad or poorly aligned with the target market. Many sites target generic phrases related to financial services without considering intent. Someone reading general advice is not always ready to speak to a professional. If the content does not guide them towards a logical next step, the visitor is likely to leave the site.

When content attracts attention but not action

Content often sits at the heart of the issue. Publishing good content is important; however, not all content serves the same purpose. Informational articles can build authority, yet they do not automatically generate qualified leads.

Many financial services websites publish blog posts that explain things clearly but never really lead anywhere. The reader finishes the article understanding the topic, but with no idea what to do next. For someone looking for financial guidance, this doesn’t fill them with confidence. The reader needs to know what the next steps are for them by covering their concerns in the content.

Content that performs well balances insight with the next steps. It addresses the real questions, not just abstract topics. It explains these ideas in plain language without stripping away expertise so readers can easily understand. Most importantly, it gently leads the reader towards a decision, even if that decision is simply to learn more or ask a question.

Clarity beats cleverness every time

A surprising number of websites fail a simple test. Within seconds, a visitor should understand what is offered, who it is for, and what to do next. If any of those elements are unclear, hesitation sets in.

Financial services sites often rely on polished language that sounds impressive but explains very little. Phrases about tailored solutions, holistic advice, or comprehensive planning rarely answer the visitor’s unspoken question, which is whether this service fits with what they need.

Clear explanations outperform clever wording. Visitors should instantly recognise the type of support available and how the process begins. Without that clarity, even well-designed pages struggle to convert interest into work.

Layout and user experience shape trust

User experience is not just about aesthetics. It is about how easily someone can navigate uncertainty. Financial decisions carry weight, and confusion kills momentum.

A cluttered layout, inconsistent messaging, or hard-to-find contact options make it difficult for the reader. Even small issues can undermine confidence. If a visitor has to search for contact details or scroll endlessly to understand products or services, doubt can creep in.

Effective layouts guide attention. Information is presented in logical steps. Headings break up dense text. Calls to action appear naturally at moments where the reader feels informed enough to proceed. This structure reassures visitors that the business values clarity, which reflects positively on how it handles financial matters.

Trust is the real conversion currency

Trust plays a bigger role in financial services than in most industries. People do not enquire unless they feel safe. This extends beyond regulation badges or professional qualifications.

Trust is built through transparency. Clear explanations of how the relationship works, what happens after an enquiry, and how personal information is handled all reduce anxiety. Testimonials and case studies provide reassurance, particularly when they describe real experience rather than vague information.

Many websites hide trust elements on separate pages, assuming visitors will seek them out. In reality, trust signals work best when they appear alongside calls to action. Seeing evidence of competence at the exact moment a decision is required makes a measurable difference.

Calls to action that respect hesitation

Calls to action are often misunderstood. Aggressive prompts to book a consultation can feel premature, especially for visitors early in their research. That does not mean calls to action should be weak or absent.

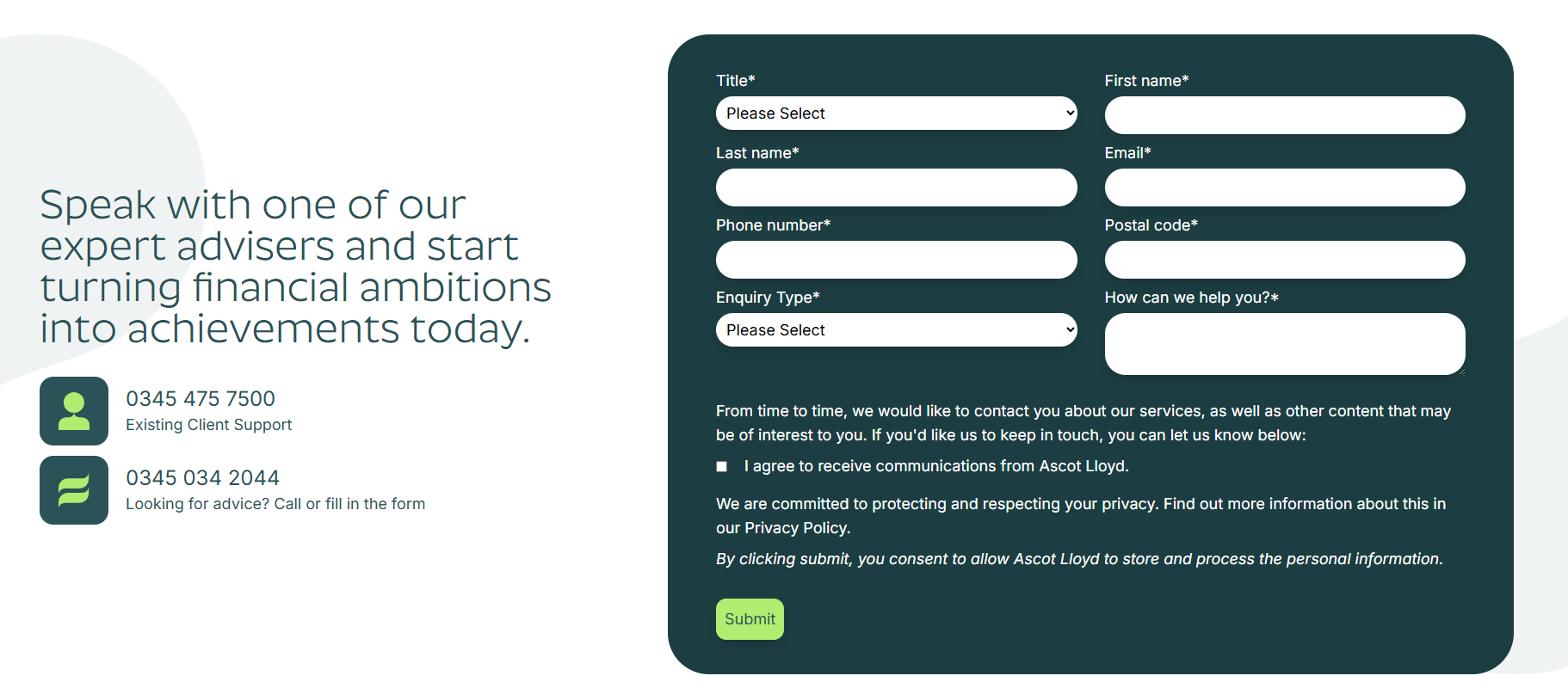

CTA from Ascot Lloyd

The best calls to action in financial services acknowledge hesitation. They offer low-pressure options that feel safe, such as requesting information, downloading guidance, or arranging an initial conversation rather than a full commitment.

Subtle variation matters. A well-placed call to action that aligns with the content context feels helpful rather than sales-driven. When visitors feel in control, they are far more likely to respond.

Why your website may not feel relevant enough

Relevance is a powerful conversion driver. Many sites try to appeal to everyone seeking financial help, but that broad approach often backfires. Visitors want to feel understood, not categorised.

Defining a clear target market improves relevance instantly. Whether the focus is on business owners, families planning for retirement, or individuals navigating financial situations, specificity signals expertise. It tells the visitor that the business understands their challenges and has experience addressing them.

Content, imagery, and examples should reinforce this focus. Case studies that reflect the target audience create a connection. They show that the firm has helped people with similar concerns and outcomes, which builds confidence without exaggeration.

Digital marketing without direction wastes opportunity

Digital marketing efforts often focus on visibility, but visibility without strategy leads to wasted efforts. Marketing strategies should be aligned with lead generation goals, not vanity metrics.

Traffic sources matter. Social platforms, search engines, and referral sites attract users at different stages of awareness. Understanding where visitors come from helps shape messaging and page structure.

Analytics provide insight into where users may leave the site. High exit rates on key pages often indicate confusion or unmet expectations. Addressing these issues can transform existing traffic into leads without increasing spend.

Measuring what actually matters

Many businesses track visits but ignore behaviour. Metrics such as time on page, scroll depth, and interaction with calls to action reveal far more about intent.

When data is reviewed consistently, patterns emerge. Certain pages attract attention but fail to convert. Others quietly generate enquiries with minimal traffic. These insights guide refinement, allowing content and layout to evolve based on evidence rather than assumption.

Bringing it all together

When asking the question of why doesn’t my financial services website produce more leads, the answer rarely lies in a singular flaw. It is usually a combination of misaligned traffic, unclear messaging, underused trust signals, and calls to action that fail to match what the visitor is looking for.

A website that generates leads does not pressure users but speaks directly to the concerns of people seeking financial advice and builds confidence through proven expertise.

For financial advisors, success comes from understanding not just how to attract attention, but how to convert interest into conversation. When digital marketing, content, and structure work together, lead generation becomes a natural outcome rather than a constant frustration.

Conclusion

If your website attracts visitors but fails to generate enquiries, it is not a sign that online lead generation does not work in financial services. It is a sign that something within the journey needs refinement. Addressing clarity, trust, relevance, and user experience can transform existing traffic into meaningful conversations.

For those who want expert guidance on improving lead generation and building a website that genuinely supports business growth, speaking with Perpetual10 can provide clarity on what to fix, what to prioritise, and how to move forward with confidence.